What are the challenges and solutions in implementing blockchain for digital identity verification?

In an increasingly digital world, identity verification has become a critical issue. Traditional methods often fall short when it comes to security, efficiency, and convenience. Enter blockchain technology, a revolutionary solution that promises to address these shortcomings. But what are the challenges and solutions in implementing blockchain for digital identity verification? In this article, we'll explore the complexities and potential strategies associated with deploying blockchain-based digital identity systems.

The Complexity and Necessity of Digital Identity Verification

Digital identity verification is an essential aspect of our modern lives. Whether signing up for a new online service, accessing social media, or managing personal data, secure digital identities are crucial. However, current systems often fail to provide the security and efficiency needed to protect users.

En parallèle : How does the AI compliance officer help organizations navigate complex regulations?

Traditional identity verification systems rely heavily on centralized databases. These centralized systems are vulnerable to breaches, identity theft, and other security risks. As we move into a more connected world, the demand for robust, decentralized solutions grows stronger. This is where blockchain technology offers significant promise.

Introduction to Blockchain Technology and Digital Identity

Blockchain technology offers a decentralized, transparent, and secure way to manage digital identities. Unlike traditional systems, blockchain provides a theoretically tamper-proof ledger of transactions and data. This immutability makes it an attractive option for identity verification.

Cela peut vous intéresser : How can edge AI be used to enhance real-time decision-making in manufacturing?

In a blockchain-based system, each user’s identity is encrypted and stored across a distributed network. The decentralized nature of blockchain ensures that no single entity has complete control. This decentralized approach addresses many of the vulnerabilities found in centralized systems. However, implementing such a system isn't without its challenges.

Challenges in Implementing Blockchain for Digital Identity Verification

Implementing blockchain for digital identity verification presents several challenges. These range from technical hurdles to regulatory and social acceptance issues.

Technical Challenges

One of the primary technical challenges is scalability. Blockchain networks, like Bitcoin and Ethereum, have faced issues scaling to accommodate a large number of transactions. Identity verification systems require real-time processing, which current blockchain solutions may struggle to handle.

Another technical challenge is interoperability. Digital identity systems must work across various platforms and services. Ensuring seamless integration with existing systems and future technologies is a complex task. Without interoperability, the full potential of blockchain-based digital identity solutions can't be realized.

Regulatory Challenges

Regulatory challenges are another significant hurdle. Digital identity verification must comply with various regulations and standards, which vary by region. Navigating these regulations can be a complex and time-consuming process. Moreover, governments need to establish a clear regulatory framework for blockchain technology itself, which is still evolving.

Social Acceptance and User Adoption

Social acceptance and user adoption present another set of challenges. Users must trust and understand blockchain-based systems. Overcoming skepticism and educating the public on the benefits and functionalities of blockchain is crucial for widespread adoption.

Solutions for Blockchain-Based Digital Identity Verification

Despite these challenges, there are viable solutions to implement blockchain-based digital identity verification effectively.

Scalability Solutions

To address scalability issues, various layer 2 solutions and consensus algorithms are being developed. Layer 2 solutions like sidechains and state channels help offload transactions from the main blockchain, improving processing speed and scalability. Advanced consensus algorithms, such as Proof of Stake (PoS), also offer more efficient alternatives to traditional methods like Proof of Work (PoW).

Interoperability Solutions

Interoperability can be enhanced through standardization and collaboration among blockchain developers and industry stakeholders. Projects like W3C's DID (Decentralized Identifiers) and VC (Verifiable Credentials) standards are paving the way for more interoperable systems. These standards ensure that digital identities can be verified across different platforms and services without compatibility issues.

Regulatory Solutions

To navigate regulatory challenges, companies and developers must engage with policymakers and regulators to create a supportive environment for blockchain technology. This involves participating in regulatory sandbox programs and pilot projects to demonstrate the technology's potential and gather feedback. Establishing clear guidelines and best practices for compliance will also help build trust with regulators and users alike.

Building Trust and User Adoption

Building trust and encouraging user adoption involves education and transparency. Providing users with clear information on how blockchain-based digital identity systems work, and the benefits they offer, can help overcome skepticism. Demonstrating real-world use cases and success stories will also boost confidence in the technology.

Enhancing Security

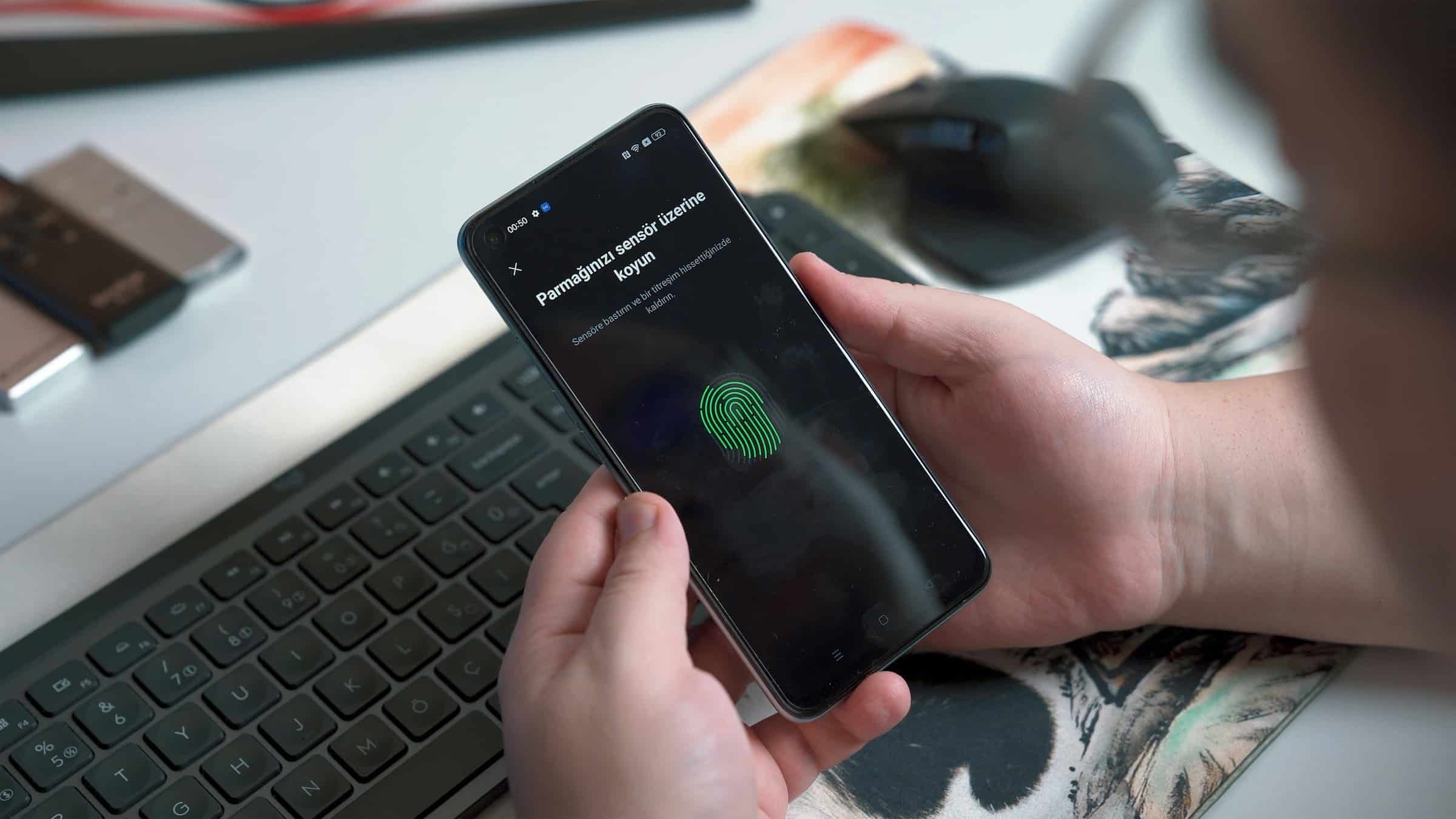

Security remains a top priority for digital identity verification. Blockchain's decentralized nature inherently offers enhanced security compared to centralized systems. However, additional measures such as multi-signature wallets, zero-knowledge proofs, and biometric authentication can further bolster security. These technologies can help ensure that only authorized users have access to their personal data, reducing the risk of identity theft.

Real-World Applications and Future Prospects

Blockchain-based digital identity verification has already seen successful implementations in various sectors. From financial services and healthcare to cross-border transactions and sovereign identity initiatives, the potential applications are vast.

Financial Services

In the financial sector, blockchain technology is being used to streamline KYC (Know Your Customer) processes. Blockchain-based KYC platforms enable banks and financial institutions to verify identities more efficiently and securely. This reduces the risk of fraud and identity theft while improving the overall user experience.

Healthcare

In healthcare, blockchain can provide secure and interoperable health records. Patients can control access to their medical data, ensuring privacy and security. This can lead to more efficient and accurate treatment, as healthcare providers have access to complete and up-to-date patient information.

Cross-Border Transactions

Blockchain technology also facilitates cross-border transactions and identity verification. Traditional methods of cross-border verification are often slow and expensive. Blockchain offers a faster, more cost-effective solution. This is particularly beneficial for refugees and migrants who lack official identification documents.

Sovereign Identity Initiatives

Sovereign identity initiatives leverage blockchain to provide citizens with a secure and self-sovereign digital identity. These initiatives empower individuals to control their own identity data, reducing the reliance on government-issued IDs. This can be especially transformative in regions with underdeveloped identification systems.

In conclusion, while there are significant challenges in implementing blockchain for digital identity verification, there are also promising solutions. Addressing technical, regulatory, and social challenges requires collaboration and innovation from all stakeholders. Blockchain technology offers a more secure, efficient, and decentralized approach to digital identity verification. By overcoming these hurdles, we can unlock the full potential of blockchain-based identity solutions, providing users with secure and trusted digital identities.

The potential of blockchain for digital identity verification is vast. As the technology evolves and more solutions are developed, we can expect to see greater adoption and integration across various sectors. With continued efforts in addressing challenges and improving user trust, blockchain-based digital identity verification will play a crucial role in the future of secure and efficient identity management.